When a loved one passes away in Las Vegas, one of the first questions families face is: What happens to their assets?

That’s where Las Vegas probate comes in. While the process may sound intimidating, understanding how it works in Clark County can make it far less overwhelming.

Let’s break it down clearly — from what probate actually means to how Nevada’s unique rules determine which process applies to your situation.

Defining Probate in Las Vegas: Clark County

What is Probate?

Probate is the legal process that ensures a deceased person’s assets are distributed according to their will — or, if no will exists, in line with Nevada’s intestate laws.

It’s a Las Vegas probate court-supervised procedure that validates the will, pays off debts, and transfers remaining assets to rightful heirs. Think of it as the court’s way of making sure everything is done properly, transparently, and finally.

Jurisdiction: Why Clark County District Court Handles Probate

In Las Vegas and the surrounding areas, probate cases fall under the Eighth Judicial District Court of Clark County.

This court has jurisdiction over estates where the deceased was a Clark County resident or owned property here. All probate petitions, filings, and hearings go through the Family Division of this court.

The Role of the Probate Commissioner

Clark County has two designated Probate Commissioners — PC-1 and PC-2 — who oversee the day-to-day progression of probate cases. They conduct hearings, issue recommendations to the district judges, and help keep the process moving efficiently.

In short, the Probate Commissioners are the local experts who ensure that estates are handled fairly and according to Nevada law.

Assets That Avoid Probate

Not all assets have to go through probate. Some transfer automatically upon death. These include:

- Joint Tenancy assets – property owned jointly with rights of survivorship.

- Payable-on-Death (POD) or Transfer-on-Death (TOD) accounts – like bank accounts or brokerage accounts with named beneficiaries.

- Life insurance policies – when a beneficiary is listed.

- Trust assets – any property held in a revocable living trust.

If an estate is structured with these tools, many families can skip probate altogether — or at least simplify it dramatically.

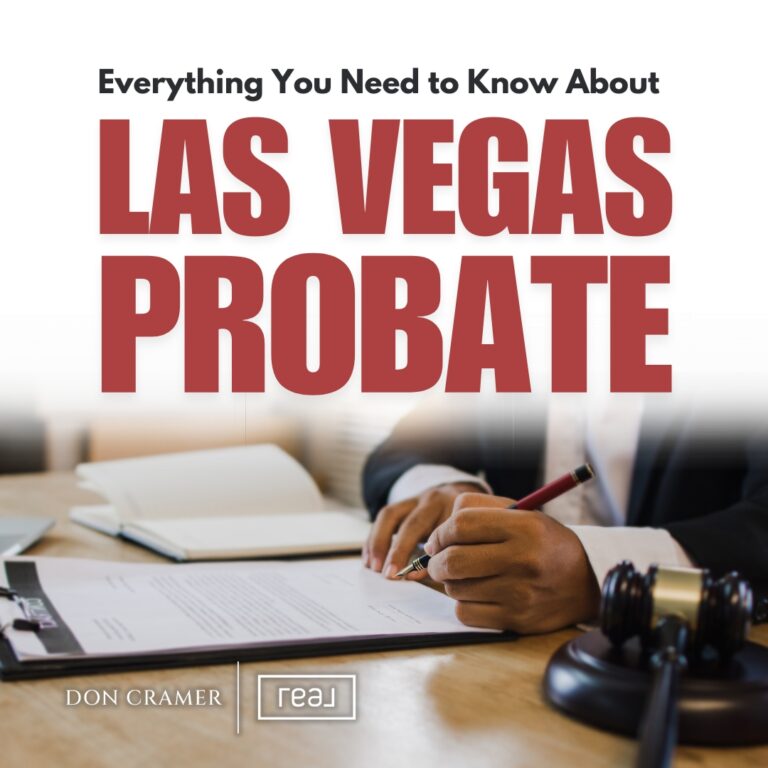

Nevada’s Three Tiers of Probate: The Estate Value Thresholds

Nevada’s probate system is designed to fit the size of the estate. Depending on the total value, your case may qualify for a simplified process. Here’s how it breaks down.

Small Estate Affidavit: NRS 146.080

Small Estate Affidavit, governed by NRS 146.080, is the simplest and most streamlined probate option in Nevada.

It applies when the total value of the probate estate—excluding real estate and vehicles—is under $25,000, or under $100,000 if the claimant is a surviving spouse. This process does not require a court hearing.

Instead, the heir completes and presents a sworn affidavit directly to asset holders, such as banks or financial institutions, to release the funds or property.

The only waiting requirement is that at least 40 days must pass after the date of death before the affidavit can be used. Because of its simplicity and minimal paperwork, this method is ideal for small estates with limited assets and no disputes among heirs.

Set-Aside Administration: NRS 146.070

Set-Aside Administration, outlined in NRS 146.070, applies to estates valued at under $100,000. In these cases, the court has the authority to “set aside” the estate, transferring ownership directly to the surviving spouse or minor children.

The process begins with filing a petition in the Clark County court, followed by a brief hearing where the judge reviews the estate’s details. If approved, the court issues an order allowing the property to be transferred directly to the rightful heirs.

One major advantage of this option is that it can include real estate, unlike the Small Estate Affidavit. This makes Set-Aside Administration particularly beneficial for modest estates that include a family home or other real property.

Summary Administration: NRS Chapter 145

Summary Administration, governed by NRS Chapter 145, applies to estates valued between $100,000 and $300,000. This process is still a formal probate procedure, but it offers a more streamlined and cost-effective alternative to full administration.

One of its key advantages is the shorter creditor claim period—only 60 days instead of the standard 90—allowing the estate to be settled more quickly.

Summary Administration serves as a practical middle ground: it provides sufficient court oversight for moderately complex estates while avoiding the extended timelines and higher costs typically associated with general probate.

General (Full) Administration

General (Full) Administration applies to estates valued at over $300,000, or those involving complex assets, disputes, or unclear property titles. This process represents the most formal and comprehensive level of probate in Nevada.

Because of the estate’s size or complexity, it requires detailed legal filings, multiple rounds of court approvals, and ongoing oversight by the Probate Commissioner throughout the proceedings.

As a result, full administration tends to take longer than other probate types but ensures that every aspect of the estate is handled thoroughly and in strict compliance with Nevada law.

The 6-Step Las Vegas General Probate Process

For estates that fall under General Administration, here’s what you can expect step by step:

Step 1: Filing the Petition

Within 30 days of death, the original will must be lodged with the Clark County Clerk’s Office. The court is petitioned to appoint a Personal Representative (Executor or Administrator) who will handle the estate.

Step 2: Notice to Creditors

The Personal Representative must publish a Notice to Creditors in a local newspaper and mail notices to known creditors. This starts the 90-day claim window during which creditors can file claims.

Step 3: Inventory and Appraisal

All probate assets are identified, gathered, and appraised. This Inventory and Appraisal must be filed within 120 days after appointment.

Step 4: Payment of Debts and Taxes

The estate pays valid debts, outstanding bills, and any state or federal taxes owed.

Step 5: Accounting

The Personal Representative submits a detailed accounting to the court, showing all income, expenses, and distributions made on behalf of the estate.

Step 6: Distribution and Discharge

Finally, the court approves the distribution of remaining assets to heirs or beneficiaries and formally closes the estate, releasing the Personal Representative from duty.

Understanding Timeline and Costs

The length and cost of probate in Las Vegas depend largely on the size and complexity of the estate. Summary Administration, which applies to estates valued between $100,000 and $300,000, generally takes about three to four months to complete.

In contrast, General Administration, reserved for larger or more complex estates, typically lasts six months to a year—and sometimes longer if there are disputes among heirs, multiple properties to manage, or assets that are difficult to appraise.

When it comes to costs, Nevada law sets statutory fees for both Las Vegas probate attorneys and personal representatives. These fees often start at about 4% of the first $100,000 of the estate’s value, with the percentage decreasing as the estate grows.

Court filing fees usually amount to a few hundred dollars, depending on the estate’s total value. Additionally, the law requires publication of a Notice to Creditors in a local newspaper, which can cost between $200 and $400.

In some cases, if the personal representative must be bonded, the estate will also pay a bond premium, a type of insurance ensuring the representative fulfills their duties properly.

While probate expenses can add up, thoughtful estate planning—such as creating a trust or designating beneficiaries—can minimize or even eliminate many of these costs altogether.

Conclusion

While the word probate often brings to mind long court processes and stacks of paperwork, the truth is that Las Vegas probate is predictable and manageable—especially when you understand the system.

Nevada’s tiered structure ensures that the process matches the estate’s size and complexity, from the simple Small Estate Affidavit to the more detailed General Administration. Each pathway serves a purpose, helping families settle their loved one’s affairs in a structured and legally sound way.

If you have any questions about this article, feel free to contact us. And if you would like to explore the real estate offerings in Las Vegas, NV, give us a call today at 702-389-7369 or email us at info@vegashomesnv.com to schedule an appointment.

Frequently Asked Questions

How long does probate usually take in Las Vegas?

Anywhere from 3 months to a year, depending on estate size, disputes, and court scheduling.

Is probate always required in Nevada?

No. If assets are held in trust or pass through beneficiary designations, probate may not be needed.

What’s the difference between General and Summary Administration?

Summary Administration is a faster, simplified version for estates under $300,000. General is for larger or more complex estates.

What is the deadline for filing the Will?

Nevada law requires filing the original will within 30 days of death with the Clark County Clerk.

Can I handle probate without an attorney?

Technically yes, but because the process involves strict deadlines and filings, most families choose to hire a Nevada probate attorney to ensure accuracy.

What assets count toward the estate value?

Only probate assets — those not jointly owned or without designated beneficiaries — are included in calculating estate value.